Estate and Incapacity Planning

Canadian Powers of Attorney and United States Persons

We frequently encounter folks who wish to appoint a US citizen or a US resident as attorney under their power of attorney. Often folks wish to appoint a child who has moved to the US for work, or a spouse, sibling, or friend who lives in Canada but is a dual citizen.

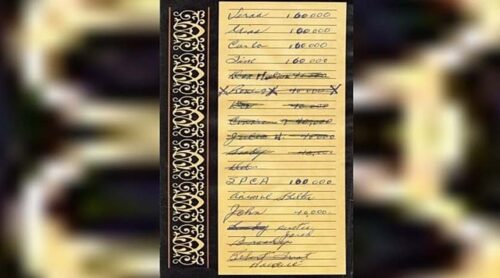

Read MoreWhat About Unsigned Wills?

What makes a will valid in British Columbia? What makes an amendment to a will valid?

Read MoreIt’s Never “Just a Will”

We often hear some variation of the following: “I have a simple life and I want a simple will. Why are you asking for detailed information about my house(s), bank accounts, investments, life insurance, etc.?” In today’s post, we will provide a brief overview of why such information is so important for a lawyer asked to draft someone’s will.

Read MoreBlended Families and Estate Planning – Part 2

In part 2, e focus on the related topic of will variation claims, a matter that should be of serious concern for anyone living in a blended family.

Read MoreBlended Families and Estate Planning

Families in which one or both spouses have children from a previous relationship, known as blended families, present some particularly tricky challenges when it comes to estate planning.

Read MoreWhat Happens if I Die Without a Will?

This is a question we are asked regularly, usually by a relative of a deceased individual who does not have a will. This month we will explain some of the basics of the laws in British Columbia relating to dying without a will, also known as “intestacy” or “dying intestate”.

Read MoreWho is in Charge if an Executor Dies Before Completing Administration of an Estate?

Sometimes, an executor dies after beginning, but before completing, administration of an estate. Then, the question arises: who is responsible for completing the administration of the estate? Usually, this question is answered by the provisions of one’s will specifying alternate executors. On occasion though, either a will’s drafting does not address this possibility, or despite providing for several alternative executors, none of the named alternate executors are willing or able to take on the role.

Read MoreCan an Attorney Sell to Himself Using a Power of Attorney?

When one is appointed as an attorney under a power of attorney document that has been put in place by another individual (the “donor”) and acts as an attorney for the donor, one is acting as a fiduciary in relation to the donor. This means that one is subject to the associated duties, restrictions, and potential liabilities of a fiduciary.

Read MoreDisclosure Requirements under the Property Transfer Tax Act – A Brief Overview

Over the past few years, various levels of government have introduced a variety of information collecting mechanisms in an effort to improve transparency surrounding property ownership and fight financial crime. This month we will discuss some relatively recent changes to the reporting required under the Property Transfer Tax Act (the “Act”). When an interest in…

Read More“When I Die” File

Often people focus on who will be in charge of their estate and who will benefit from it when planning for their eventual passing. Certainly, these are important issues and putting a will in place to address these issues is a vital part of most estate plans, but there are additional steps that can be…

Read More